The truth about prices, inflation, wages, mortgage rates — and what it means for the Gravesend market

If you’ve been watching the property market over the past few years, you’ll know it’s been one of the most dramatic and unpredictable periods in modern UK housing history.

We saw sharp increases through 2020–2022… then the brakes slammed on.

Mortgage rates jumped.

Inflation surged.

Wages shifted.

Confidence paused.

Now, a new question is emerging:

👉🏻Are homes actually cheaper today than they were at the peak in 2022?

It sounds unlikely, especially when sale prices haven’t visibly crashed, but the real answer is:

Yes. In real terms, homes today are more affordable and effectively cheaper.

And nowhere is this clearer than in Gravesend and the surrounding villages.

Let’s break it down.

1️⃣House Prices: Flat Since 2022

Across the UK, average home values today are hovering close to the peak levels of 2022.

In Gravesend, Riverview Park, Istead Rise, Meopham, Sole Street, New Barn and surrounding areas, we’ve seen the same pattern:

- No collapse in prices

- No dramatic surge

- Just remarkably stable values

On the surface, that suggests nothing has changed.

But that surface view is misleading.

2️⃣Wages Up, Prices Flat

Over the past few years, wages across the UK have continued to rise, while house prices have barely moved.

So although the asking price printed on a property hasn’t shifted much… your income has.

That means:

- You now need less of your salary to buy the same home

- Your income stretches further

- Affordability has improved

This didn’t happen by prices falling.

It happened because wages rose.

3️⃣Mortgage Rates Have Fallen Back

After the financial shock of 2022/23, we entered a period of sharply higher borrowing costs. Mortgage rates spiked, affordability crashed, and buyer confidence evaporated almost overnight.

Today, rates have eased and are trending lower.

So even if a home costs roughly the same number of pounds as it did in 2022…

- Your monthly cost to borrow is lower

- Your repayments are cheaper over the term

- Your buying power has increased

Mortgage rates move markets, and right now, they’re helping.

4️⃣ Inflation Has Quietly Reduced the Real Cost of Housing

This is the most misunderstood factor of all.

Inflation has eroded the spending power of money. The same pound today is worth less than the same pound in 2022 because prices for everything, food, fuel, services, and materials, have increased.

The impact is enormous.

A £300,000 home today is not equivalent to a £300,000 home in 2022 money.

Because inflation has risen year after year since then, the real-terms cost of that £300,000 price is significantly lower today than it was during the peak.

It hasn’t happened through falling house prices.

It has happened through the real value of money falling.

And if you’re borrowing, the benefit is even bigger:

- Mortgage debt becomes cheaper to repay over time

- Future instalments are paid with money that buys less

- The real burden of that loan reduces year after year

House prices flat + inflation up = real cost down.

5️⃣London Prices Have Fallen, and the Buyer Profile Has Changed

London values have softened noticeably since the peak. Buyers who once couldn’t afford the capital are now looking outward, and Gravesend is one of the direct beneficiaries.

But it’s not just about price.

It’s about lifestyle

Many London movers are still working from home, or only commuting into the office two or three days per week.

They’re happy to balance a slightly longer journey with:

- More space

- Bigger gardens

- Outdoor living

- Office rooms at home

- Better family environment

- Better value

Buyers who once squeezed into one-bedroom flats are now targeting three-bedroom semis with gardens… and still manage to get to London in 22 minutes.

Hybrid working has permanently changed buying priorities.

And Gravesend offers what London no longer does:

value, space, and lifestyle.

So Are Homes Cheaper Now?

Here’s the truth:

- Prices are similar to 2022

- Wages are higher

- Mortgage rates are lower

- Inflation has eroded real value

- Debt is cheaper to repay

- London’s correction is pushing demand outward

And when you look at the combination rather than any single factor:

Homes today are more affordable and effectively cheaper in real terms than they were at the peak.

Not because the market crashed, but because the underlying economics changed.

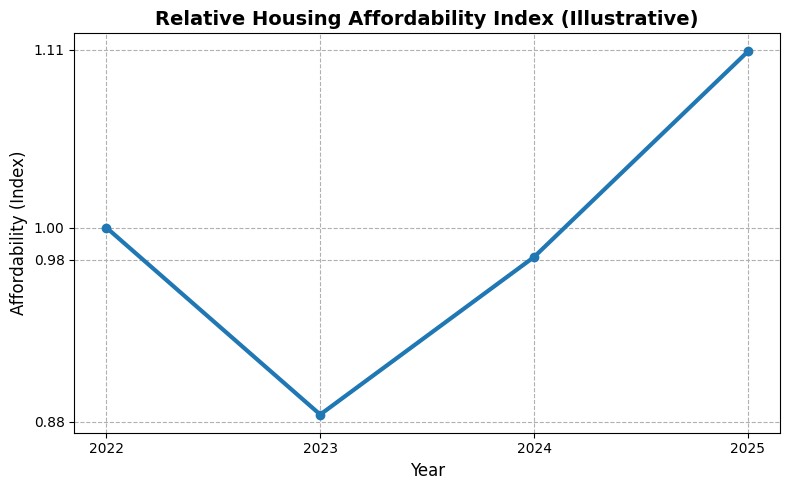

The Affordability Shift in One Chart

Here’s a simplified illustration showing how affordability has improved since 2022, even with flat nominal prices:

- 2022 = affordability baseline

- 2023 = affordability squeeze

- 2024–2025 = recovery + improvement

This is exactly why demand is picking up, especially in Gravesend.

What This Means for Gravesend Sellers

If you’re thinking of selling in 2026:

- Buyer power is rising

- Confidence is returning

- London demand is flowing outward

- Affordability momentum supports values

You’re entering the market before the next wave builds.

What This Means for Gravesend Buyers

If you’re looking to buy:

This may be the most favourable affordability window for the next decade.

Because once mortgage rates fall further and confidence grows, demand will rise — and prices will follow.

Final Thought

We’ve entered a rare period where:

Homes haven’t fallen in value

But the real cost of buying one has fallen sharply

That combination doesn’t last long.

If you’re thinking about moving in Gravesend, Istead Rise, Meopham, Sole Street, Riverview Park or the surrounding villages, now is the moment to explore it.

📲 WhatsApp me anytime: 07487 805 780

Always happy to chat options, no pressure, just clarity.