Moving home in Gravesend involves more than a deposit. Costs include Stamp Duty, solicitor fees (£2-3k), removals (£500-2k), surveys, and mortgage fees. Total expenses can reach £6k-£20k+. Planning ahead ensures a smoother, stress-free move.

Moving home is one of the biggest financial decisions you’ll make — yet many homeowners in Gravesend underestimate the true cost of moving until they’re already partway through the process.

From Stamp Duty and solicitor fees to removal costs and surveys, the cost of moving home in Gravesend involves far more than just your deposit or estate agency fees. These additional expenses can quickly add up and, without proper planning, may place unnecessary pressure on your finances at what is already a stressful time.

When buying a property, Stamp Duty Land Tax is often the largest upfront cost. This is calculated in bands based on the purchase price of your new home, meaning you only pay the relevant rate on the portion that falls within each threshold. Depending on the value of the property you are purchasing in Gravesend, this can range from a few thousand pounds to well over £10,000.

If you're planning on moving home in Gravesend this year, one of the most important things to understand early on is the true cost of moving.

Many homeowners focus on their deposit or how much equity they have in their current property — but the reality is that the cost of moving home in Gravesend involves several additional expenses that can quickly add up if you're not prepared.

In this guide, our team at Jags Property Group break down the average cost of moving house in Gravesend, including Stamp Duty, solicitor fees for selling and buying, and removal costs with and without packing services.

Stamp Duty When Buying a Property in Gravesend

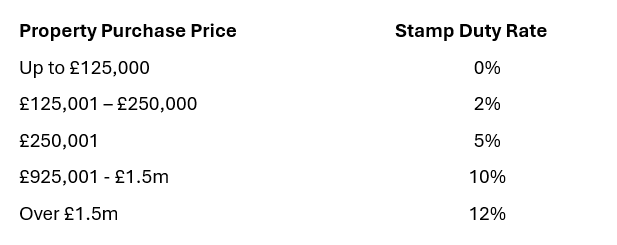

Stamp Duty Land Tax (SDLT) is usually the biggest upfront cost when purchasing your next home.

Stamp Duty is calculated in bands, which means you only pay the applicable rate on the portion of the property price within each threshold — not the full amount.

Current SDLT Rates in England:

Example: Stamp Duty on a £400,000 Property in Gravesend

0% on the first £125,000 = £0

2% on the next £125,000 = £2,500

5% on the remaining £150,000 = £7,500

✅ Total Stamp Duty Payable: £10,000

If you're purchasing a buy-to-let or second home in Gravesend, an additional 5% surcharge will apply across the entire purchase price.

Solicitor Fees for Selling and Buying a Property in Gravesend

Whether you're upsizing, downsizing or relocating within Kent, you'll need a conveyancing solicitor for both your sale and purchase.

Average Solicitor Fees in Gravesend:

Selling Your Property: £600 – £1,300 + VAT

Buying a Property: £800 – £1,900 + VAT

When you're both selling and buying, the combined legal fees for moving home in Gravesend typically fall between:

➡️ £2,000 – £3,000 total

Leasehold properties may incur slightly higher legal costs due to additional management pack and leasehold enquiries.

Removal Costs in Gravesend

Removal costs will vary depending on:

- Property size

- Volume of belongings

- Distance of move

- Ease of access

- Whether you require packing services

Removals Only:

Typically £500 – £1,500

Removals with Professional Packing Service:

Usually £1,000 – £2,000+

While packing services increase the upfront cost of moving, they can significantly reduce:

✔ Moving day stress

✔ Risk of damage

✔ Time spent preparing for completion

Many Gravesend homeowners choose to self-pack to reduce costs and hire removals for transport only.

Other Costs of Moving House in Gravesend

Additional costs you may need to budget for include:

Property Survey: £400 – £1,500

Mortgage Arrangement Fees: £500 – £2,000

Mortgage Valuation: £150 – £800

Buildings Insurance (required from exchange)

Total Cost of Moving Home in Gravesend

As a rough guide, the total cost of moving home locally when selling and buying could include:

Stamp Duty: £2,500 – £15,000+

Solicitors Fees: £2,000 – £3,000

Removal Costs: £500 – £2,000+

Surveys & Mortgage Fees: £1,000 – £3,000

➡️ Estimated Total Cost of Moving Home in Gravesend: £6,000 – £20,000+

Planning for these costs early ensures there are no unexpected financial surprises as you move towards exchange and completion.

Thinking of Moving Home in Gravesend?

At Jags Property Group, our team support you through the entire moving process — from preparing your property for sale to progressing your onward purchase — ensuring your move is as smooth and stress-free as possible.

If you're considering moving home in Gravesend and would like tailored advice on the costs involved, feel free to get in touch with our team today.